SEC: Bulk Filing Without Friction

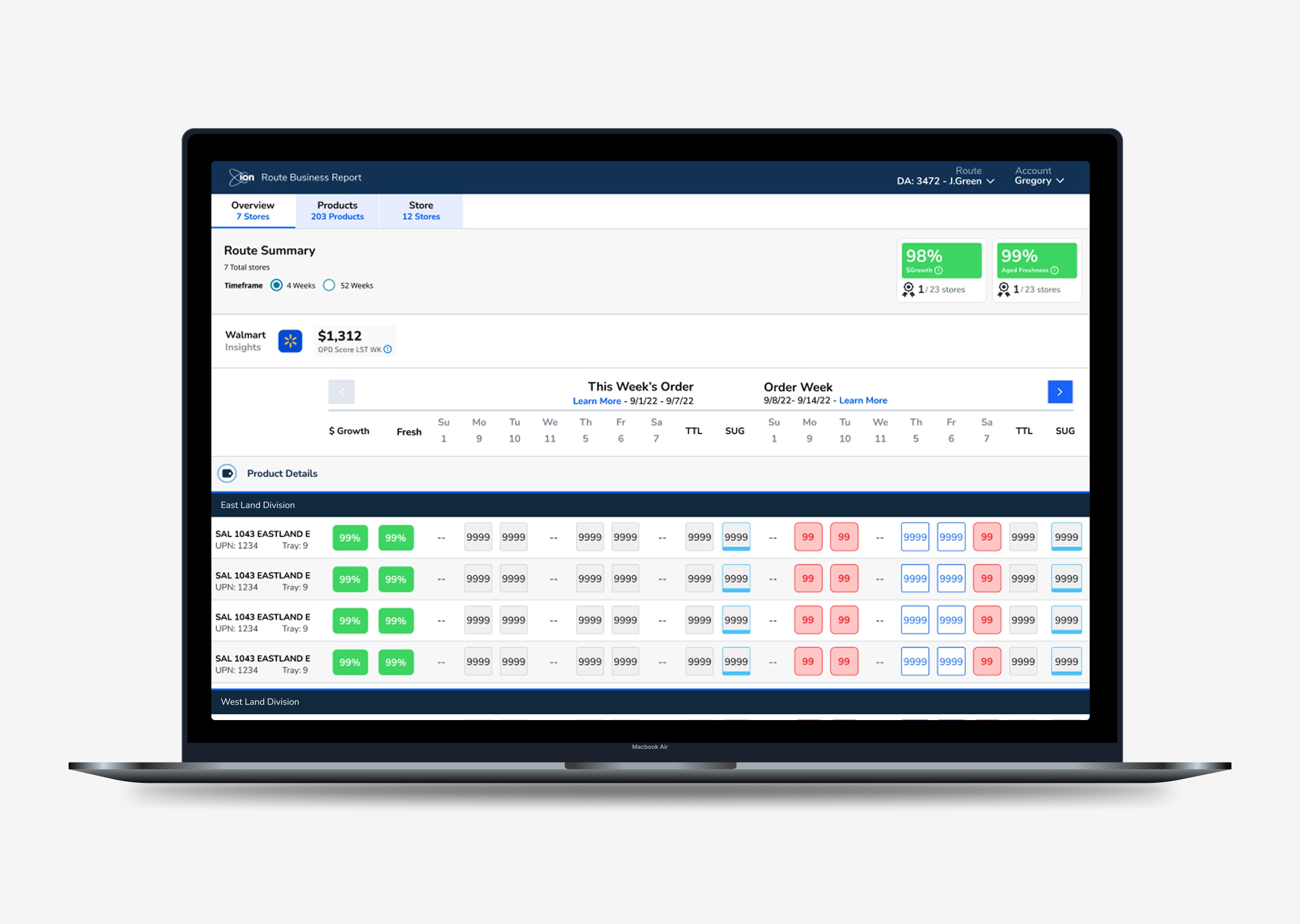

Customers needed a faster way to submit complex SEC filings in bulk while preserving accuracy, visibility, and control under aggressive deadlines. This project delivered a Bulk Filing experience that significantly reduced manual effort, streamlined collaboration, and helped mutual fund clients submit multiple forms (such as 485BPOS and 497K) more efficiently through Workiva’s SEC reporting platform.

Client

Client

Type

User Research

Year

2023

Process

Role

Deliverables: Roadmap planning, user flows, concept development, component creation, weekly and quarterly check-ins, product design, A/B testing, user testing, script creation, and final design handoff.

Duration: 9 months

Location: Based in Burlington, Vermont, collaborating remotely with a five‑member of Workiva's development team.

Outcome: Secured two new mutual fund clients, expanding revenue and engagement.

Overview

Customers needed a faster, safer way to submit complex SEC filings in bulk while preserving accuracy, visibility, and control under aggressive deadlines. The Bulk Filing initiative enabled customers to prepare and submit multiple SEC filings in a single guided workflow instead of relying on Customer Success Managers to assemble each package, which increased cost and risk. The core objective was to cut the time spent sending each package, while maintaining compliance and accuracy.

Problem & Goals

Previously, investment prospectus customers had to upload and file each document one by one for both Test and Live submissions, turning each filing cycle into hours of repetitive manual work with limited visibility into progress. Tight SEC deadlines made it difficult for small teams to complete multiple filings on time without support from Professional Services.

User needs

Let customers manage and file multiple documents in a single workflow with clear submission status.

Business needs

Improve oversight so preparers could confidently meet SEC timelines while reducing dependency on Professional Services and CSMs.

Research and Discovery

To understand the end‑to‑end journey, I created a story map of the existing SEC filing experience, mapping every step from document preparation through Test and Live filing. This exposed where users were forced into single filing and potentially failing to meet SEC deadlines under deadline pressure. I collaborated with a dedicated researcher to produce address user problems and refine High‑fidelity wireframes. The wireframes were then reviewed with design leadership and tested with customers (existing and potential) via moderated usability sessions, supported by a researcher who co‑designed scenarios, scripts, and tasks to validate speed, error risk, and confidence in meeting SEC deadlines.

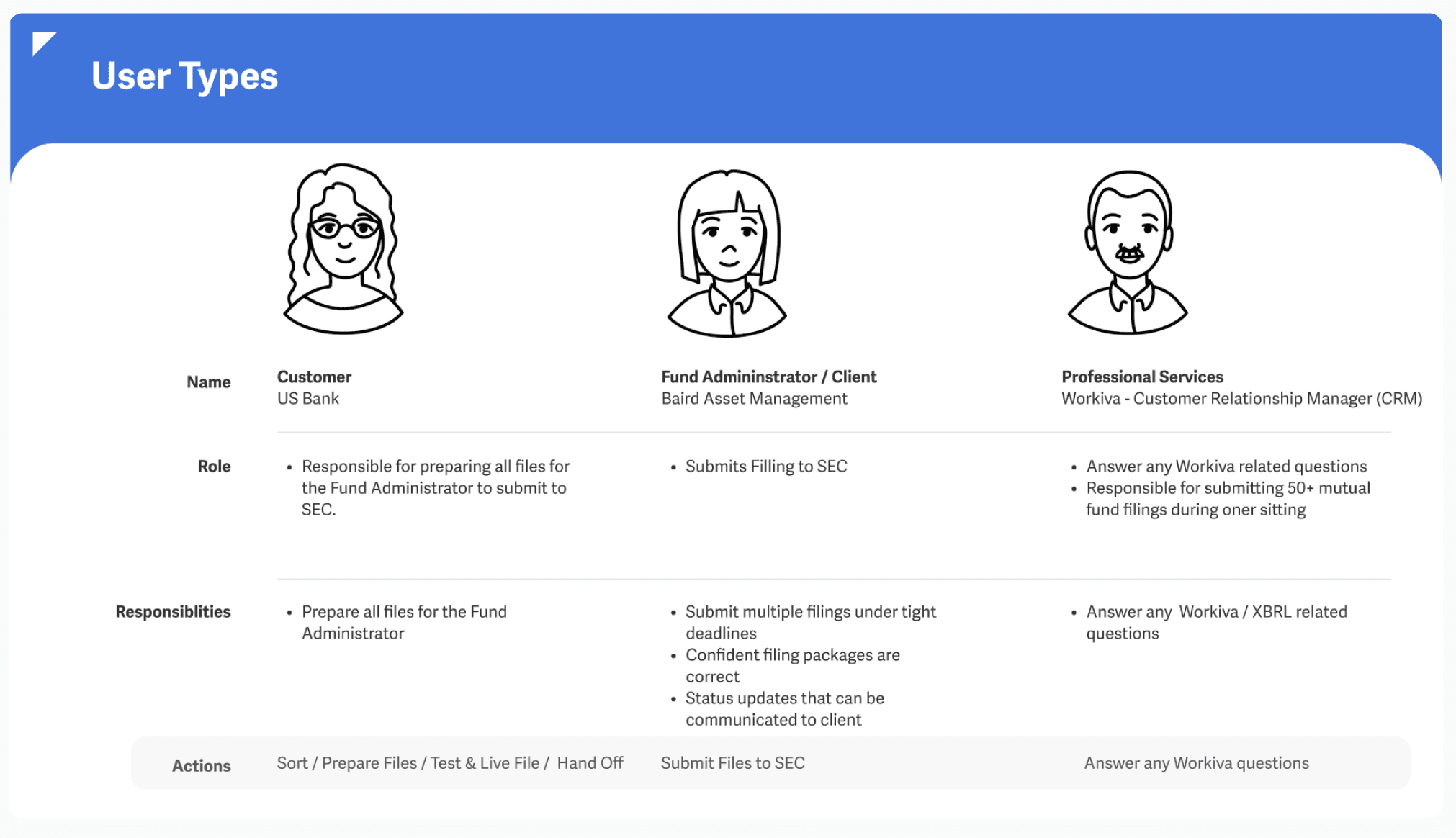

Users

With the research we were able to center our focus on three core user groups:

Fund Manager: Owns issuance and is ultimately responsible for getting multiple filings submitted and accepted on time, with zero tolerance for errors.

Fund Administrator: Acts on behalf of fund managers to prepare and file all required materials, managing high filing volumes and relying on efficient preparation, reuse, and clear multi‑filing status.

Workiva Professional Services: Supports customers with SEC mechanics and platform best practices, often acting as a safety net under deadline pressure, so product‑level efficiency directly increases service capacity.

Key pain points

Research highlighted three recurring pain areas:

Collaboration and approvals were cumbersome: Teams struggled to share in‑progress filings, collect approvals, and coordinate changes across multiple stakeholders before deadlines.

Filing and access were inefficient: Users had difficulty locating the right documents and reconciling them quickly when juggling multiple forms, versions, and filing states.

Workflow complexity was too high: Users repeatedly managed passwords, credentials, and reusable filing information for each individual filing, increasing cognitive load and error risk in bulk scenarios.

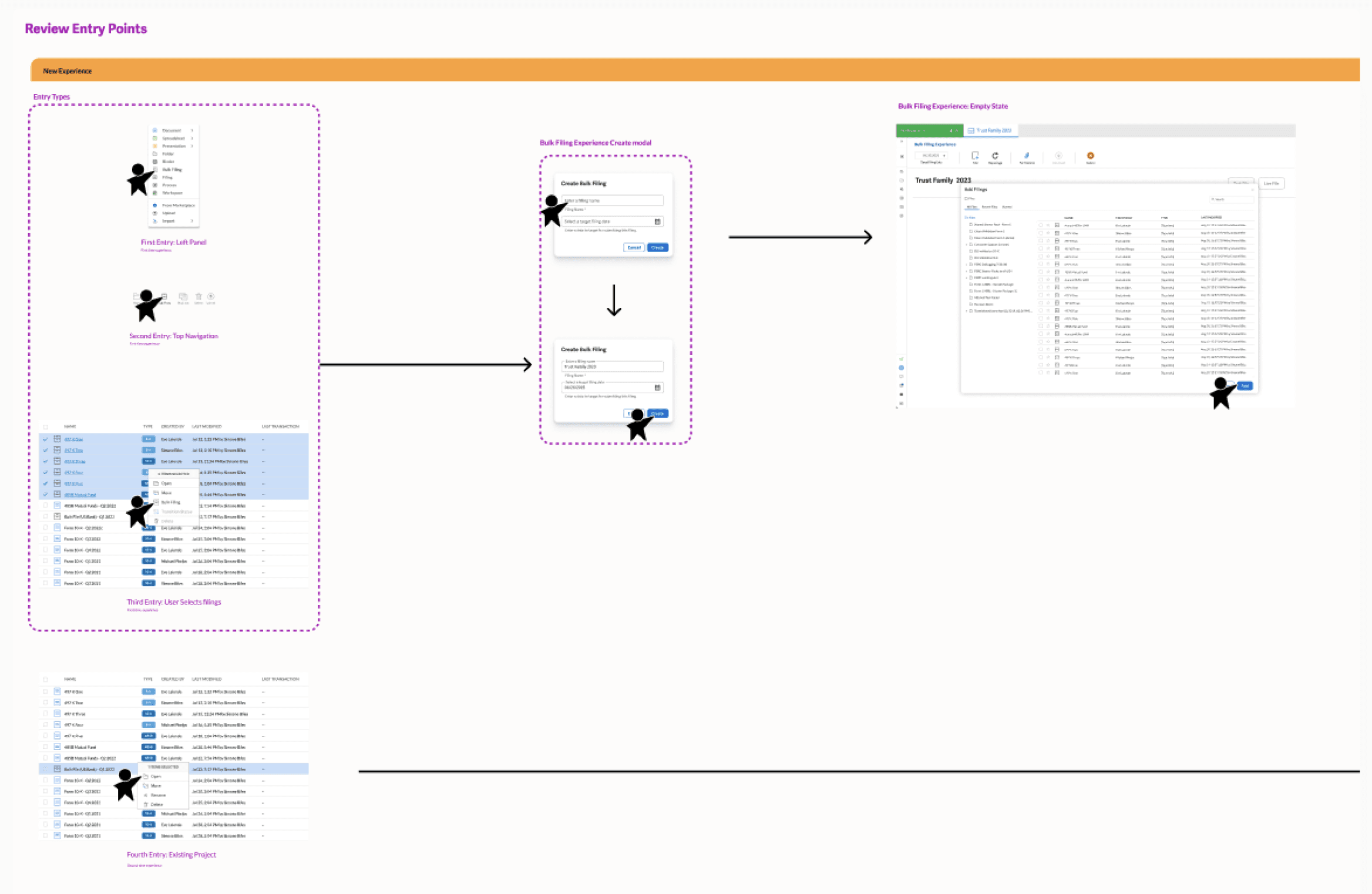

Ideation and Information Architecture

With a five month delivery window and fixed release dates, the initial design explored a one‑to‑many management pattern inspired by folder‑to‑content models from Spotify, allowing groups of items to be managed in a single view.

With peer reviews and internal walkthroughs exposed SEC‑specific edge cases and complexity, signaling that a pure net‑new pattern would introduce delivery risk. To de‑risk, the direction pivoted to enhancing the existing filing experience with a Bulk Filing template and updated IA, integrating new capabilities into current navigation and workflows to minimize change management while still unlocking bulk behavior.

Interaction Design and Testing

During our user testing we found the final designs made bulk preparation and submission safer, predictable, and transparent:

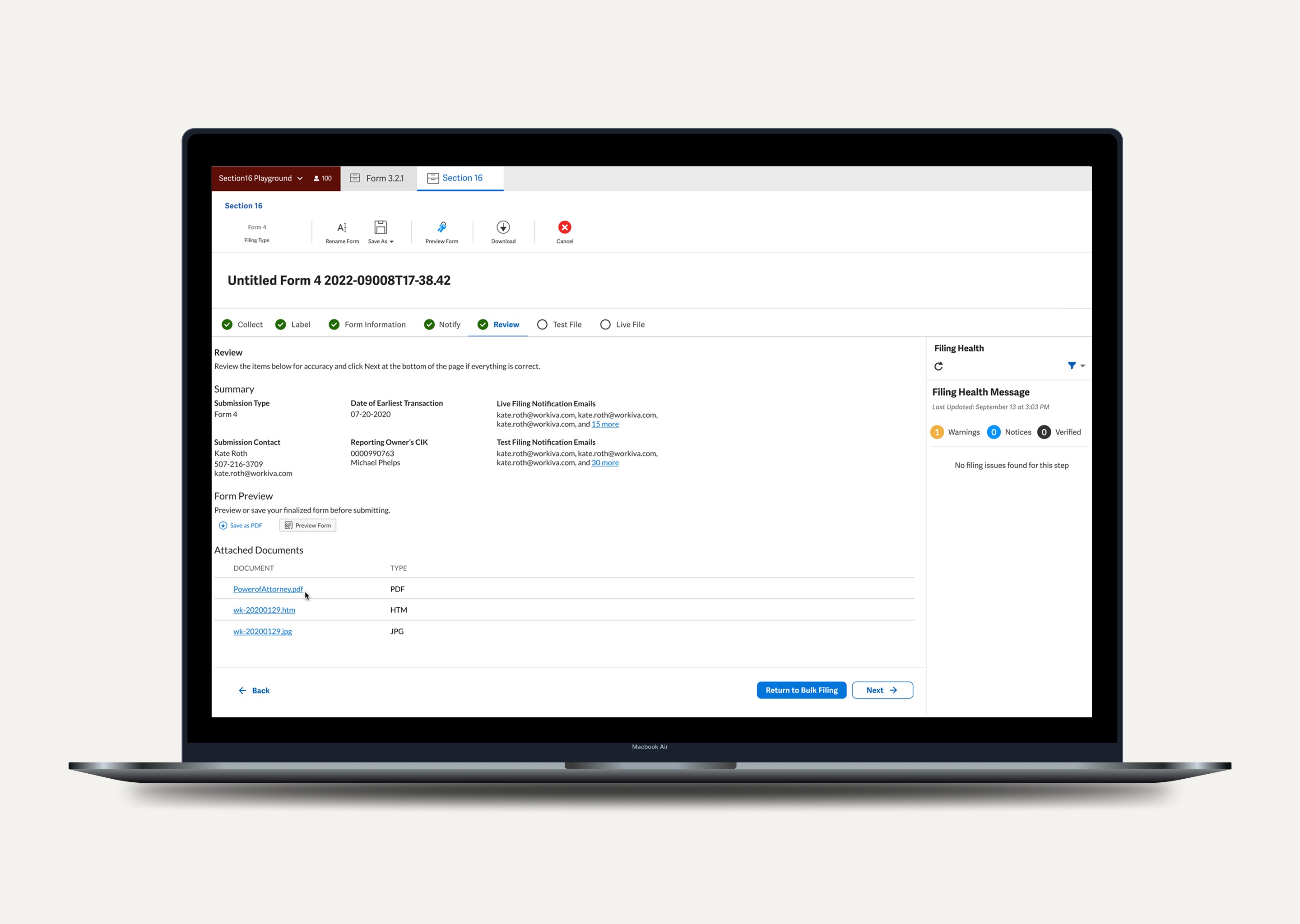

Filing workspace enhancements: Users were now able to collect and manage all relevant files for a bulk set in one workspace, clearly labeled for Health, Test, and Live states, with per‑filing status visible at a glance.

Password management: A built-in password manager, stored on the Workiva side, centralizes SEC credentials and reusable information, reducing repetitive entry and errors across multiple filings.

Ordering and queuing: Users can customize and define the sequence of submissions, and the system queues filings, so each could potentially be sent only after the previous one is accepted, critical for related forms such as 485 and 497K that require specific ordering.

Test and Live access: Users can download both Test and Live files for audit, legal, or internal review, supported by a persistent confirmation page and history view for traceability.

Live Filing confirmation UX: The confirmation dialog and messaging were redesigned to clarify risks, next steps, and automated behavior once the bulk queue starts.

Outcomes

Outcomes and Reflection

The Bulk Filing experience launched in 2023, marking a major advancement for Workiva and its customers. The new capability allowed users to prepare and manage multiple related filings within a single workflow, offering clearer per‑filing visibility and faster navigation across the entire filing lifecycle.

Users could now Test and Live file multiple forms under compressed SEC deadlines, supported by automated queuing for tightly linked forms such as 485BPOS and 497K. Integration with adjacent SEC workflows, including Section 16, further extended the platform’s value and cohesion across reporting tasks.

Early client feedback highlighted significant reductions in wizard time and improved satisfaction among mutual fund teams managing complex, recurring filings. This effort underscored the balance required between innovation and delivery risk under aggressive timelines, while advancing core goals of speed, confidence, and user autonomy.